Bookkeeping software has become an essential tool for businesses of all sizes, as it helps to streamline financial record-keeping and reporting. With a wide range of options available in the market, it can be overwhelming for businesses to choose the right software for their needs. In this article, we will take a closer look at some of the most popular bookkeeping software options in Australia and the pros and cons of each, to help you make an informed decision about the best software for your business.

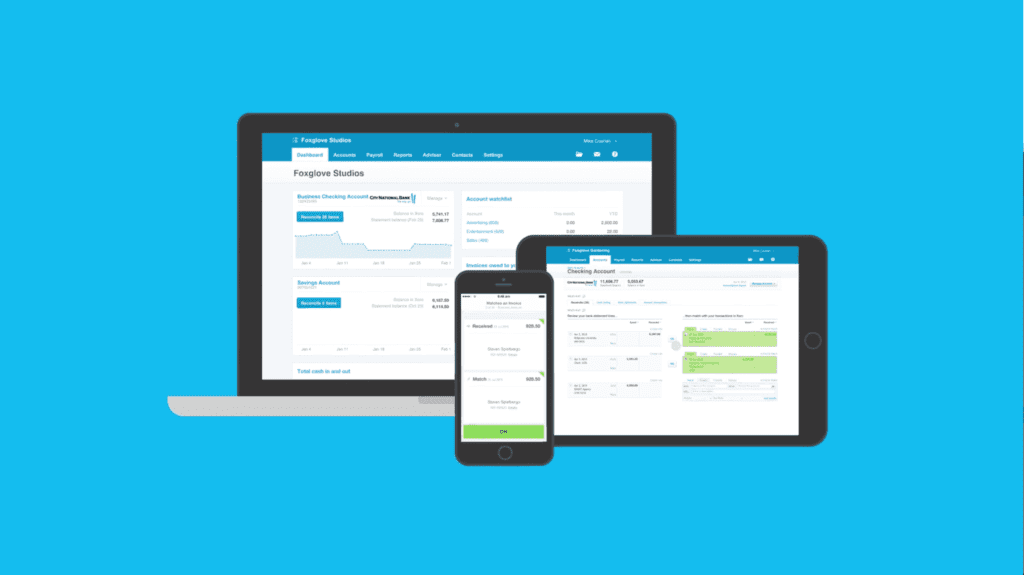

XERO

Xero is a popular bookkeeping software option in Australia, known for its cloud-based platform that allows users to manage their financial records. This software offers a wide range of features, including invoicing, expenses, and bank transactions. Xero also offers a range of integrations with other business tools, such as payroll systems and inventory management software. This makes it easy for businesses to manage all aspects of their finances from one central location. One of the key benefits of Xero is the ability to access financial records from anywhere with an internet connection, making it easy to manage business finances on the go. Additionally, Xero has an automated bank feeds and bank reconciliation feature which makes it easy to keep track of financial transactions and reduce the risk of errors.

Pros:

- Cloud-based, allowing for easy access to financial records from anywhere

- A wide range of integrations with other business tools

- Automated bank feeds and bank reconciliation

- Invoicing and expense tracking

- Mobile app available for on-the-go access

Cons:

- Limited customization options for invoicing

- Additional features and integrations can be costly

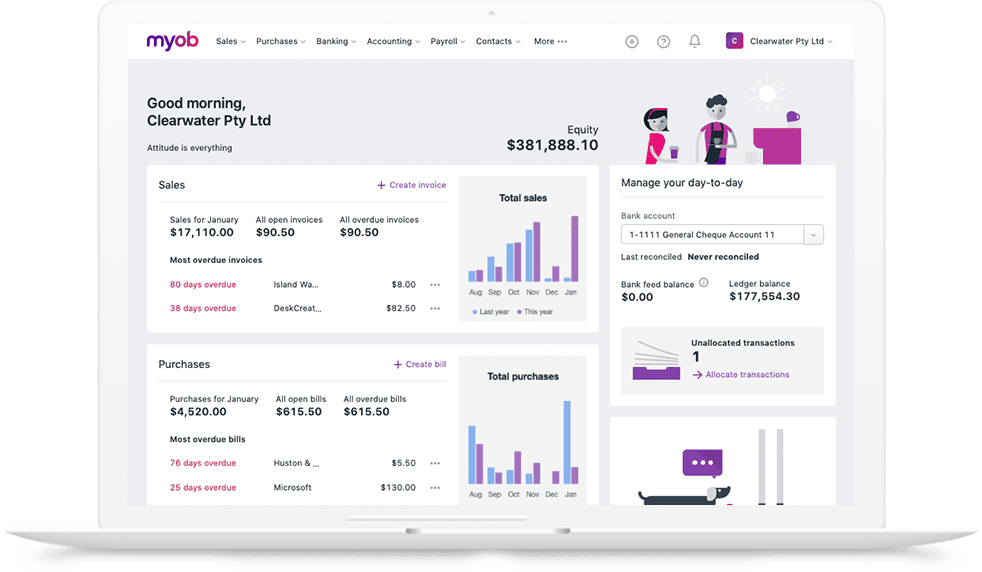

MYOB

MYOB is another bookkeeping software option that is widely used in Australia. It offers both cloud-based and desktop versions of its software, making it suitable for businesses of all sizes. MYOB provides a variety of features for managing financial records, including invoicing, expense tracking, and bank reconciliation. Additionally, it offers a range of services for businesses, such as payroll processing and tax compliance. This makes MYOB an all-in-one solution for businesses looking to streamline their financial record-keeping and reporting. MYOB is known for its easy to use interface and user-friendly navigation, making it accessible for businesses of all levels of experience with accounting software. However, some users may find the interface outdated and not as user-friendly as other options, and additional features and services can be costly.

Pros:

- Offers both cloud-based and desktop versions of the software

- A wide range of features for managing financial records

- Payroll processing and tax compliance services available

- Suitable for businesses of all sizes

Cons:

- Some users may find the interface outdated and not as user-friendly as other options

- Additional features and services can be costly

QUICKBOOKS

QuickBooks is an online accounting software that helps small businesses to manage their finances and stay organized. It offers a range of features such as invoicing, expense tracking, and bank reconciliation, it also allows you to create professional looking invoices and estimates, track time, and monitor your business’s performance. The software is designed for small businesses and sole traders, which makes it easy to use and navigate. The interface is simple and straightforward, which makes it easy for businesses of all experience levels to manage their finances. QuickBooks also offers a mobile app, allowing users to access their financial records on the go. However, it may not be suitable for larger businesses with more complex accounting needs and additional features and integrations can be costly.

Pros:

- Online accounting software that helps small businesses to manage their finances and stay organized

- Offers invoicing, expense tracking, and bank reconciliation

- Allows you to create professional looking invoices and estimates, track time, and monitor your business’s performance

- Easy to use and navigate

Cons:

- Limited customization options for invoicing

- Additional features and integrations can be costly

- May not be suitable for larger businesses with more complex accounting needs

OTHERS

Lastly, there are a number of other bookkeeping software options available in Australia, such as Reckon, Wave, and Saasu, that offer similar features and functionality.

Reckon, Wave, and Saasu

Pros:

- Simple and easy to use

- Affordable pricing options

- Suitable for small businesses and freelancers

- Offers basic features like invoicing and expense tracking

Cons:

- Limited integrations with other business tools

- Limited reporting and analysis capabilities

- Limited support options

When choosing a bookkeeping software, it is important to consider the specific needs of your business and to compare the features and pricing of different options. Many bookkeeping software providers offer free trials, so it’s a good idea to test out a few different options before making a final decision.

Overall, bookkeeping software can help businesses in Australia to stay on top of their financial record-keeping and reporting, making it easier to manage their finances and make informed business decisions. It is important to choose a software that is suitable for your business and your accounting needs, and also easy to use.

Leave A Comment